Irs 401k Catch Up Contribution Limits 2024 Max

Irs 401k Catch Up Contribution Limits 2024 Max. The internal revenue service (irs) raised the annual contribution limits for 2024 to $23,000, which amounts to a cost of living adjustment and is an increase from. Key takeaways the irs sets the maximum that you and your employer can contribute to your 401(k) each year.

1, the maximum annual benefit that may be provided through a defined benefit plan is. Irs raises 401k and ira contribution limits for 2024 retirement plans.

In 2022, The Most You Can Contribute To A Roth 401(K) And Contribute In Pretax Contributions To A Traditional 401(K) Is $20,500.

Total contributions cannot exceed 100% of an employee’s annual.

You Can Contribute A Maximum Of $7,000 (Up From $6,500 For 2023).

Each year, the irs places limits on the maximum amount participants can contribute to their 401 (k) plans.

The Irs Also Announced Defined Benefit Plan Limits For 2024.

Images References :

Source: cigica.com

Source: cigica.com

What’s the Maximum 401k Contribution Limit in 2022? (2023), For 2024, the irs has increased the contribution limit for 401(k), 403(b), most 457 plans, and the federal government's thrift savings plan to $23,000, up from $22,500 in 2023. For those with a 401 (k), 403 (b), or 457 plan through an employer, your new maximum contribution limit will go up to $23,000 in 2024.

Source: www.advantaira.com

Source: www.advantaira.com

2024 Contribution Limits Announced by the IRS, For 2024, the irs has increased the contribution limit for 401(k), 403(b), most 457 plans, and the federal government's thrift savings plan to $23,000, up from $22,500 in 2023. The 2024 401(k) individual contribution limit is $23,000, up from $22,500 in 2023.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

The Maximum 401(k) Contribution Limit For 2021, The general limit on total employer and employee. In 2024, employers and employees together can contribute up to $69,000, up from a limit of $66,000 in 2023.

Source: www.personalfinanceclub.com

Source: www.personalfinanceclub.com

The IRS just announced the 2022 401(k) and IRA contribution limits, 1, the maximum annual benefit that may be provided through a defined benefit plan is. 401 (k) contribution limits for 2024.

Source: gabrielwaters.z19.web.core.windows.net

Source: gabrielwaters.z19.web.core.windows.net

401k 2024 Contribution Limit Chart, As of 2023, individual employees have a 401 (k) contribution limit of $22,500, allowing them to contribute this amount annually to their 401 (k) account on a. Those 50 and older can contribute an.

Source: choosegoldira.com

Source: choosegoldira.com

401k 2022 contribution limit chart Choosing Your Gold IRA, Older workers can defer paying income tax on as much as $30,500 in a. The general limit on total employer and employee.

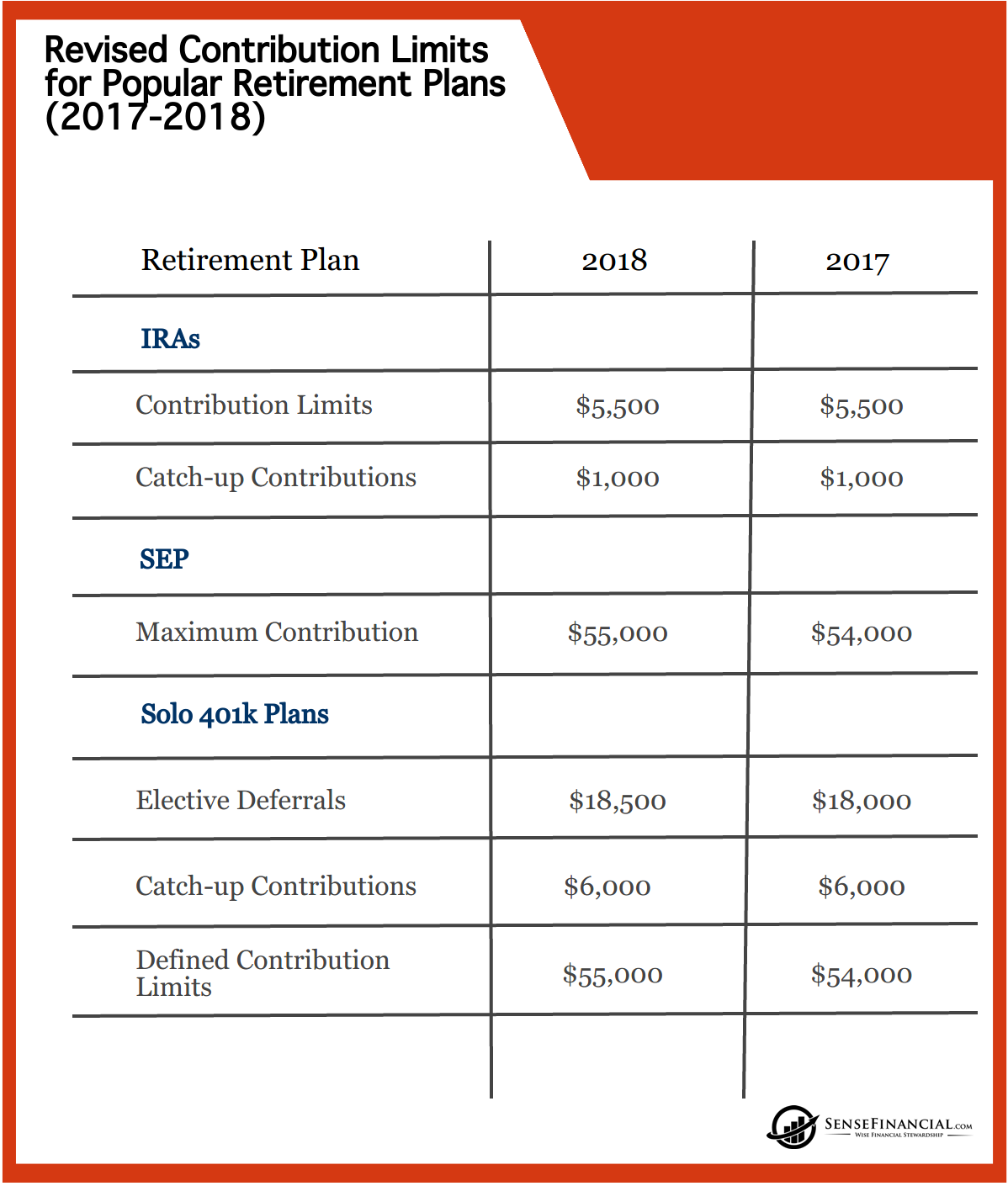

Source: www.sensefinancial.com

Source: www.sensefinancial.com

Infographics IRS Announces Revised Contribution Limits for 401(k), In 2024, employers and employees together can contribute up to $69,000, up from a limit of $66,000 in 2023. For 2023, the annual contribution.

Source: blissqcollete.pages.dev

Source: blissqcollete.pages.dev

401K Contribution Limits 2024 Dulcy Glennis, In 2022, the most you can contribute to a roth 401(k) and contribute in pretax contributions to a traditional 401(k) is $20,500. The irs revisits these numbers annually and, if necessary, adjusts them for.

Source: darrowwealthmanagement.com

Source: darrowwealthmanagement.com

2024 IRS 401k IRA Contribution Limits Darrow Wealth Management, Participants can contribute up to. For 2023, the annual contribution.

Source: rachelbolton.z13.web.core.windows.net

Source: rachelbolton.z13.web.core.windows.net

401k 2024 Contribution Limit Chart, Those 50 and older can contribute an. The general limit on total employer and employee.

Key Takeaways The Irs Sets The Maximum That You And Your Employer Can Contribute To Your 401(K) Each Year.

In 2024, employers and employees together can contribute up to $69,000, up from a limit of $66,000 in 2023.

The Irs Also Announced Defined Benefit Plan Limits For 2024.

For 2024, the irs has increased the contribution limit for 401(k), 403(b), most 457 plans, and the federal government’s thrift savings plan to $23,000, up from $22,500 in 2023.