Current Fica Rate 2024 Ny

Current Fica Rate 2024 Ny. Learn about fica for 2024, covering social security and medicare taxes. The employer fica rate is 7.65% in 2024.

The total fica tax rate is 15.3%, which is split equally between employees and employers, each paying 7.65% of their income. Use our easy payroll tax calculator to quickly run payroll in new york, or look up 2024 state tax rates.

Under Current Law, The Tax Rate Will Remain The Same At The Rate Of.

What are the fica rates and limits for 2024?

For Both Of Them, The Current Social Security And Medicare Tax Rates Are 6.2% And 1.45%, Respectively.

Attention to detail is important when discussing fica rates and limits, as they may change each calendar year.

Current Fica Rate 2024 Ny Images References :

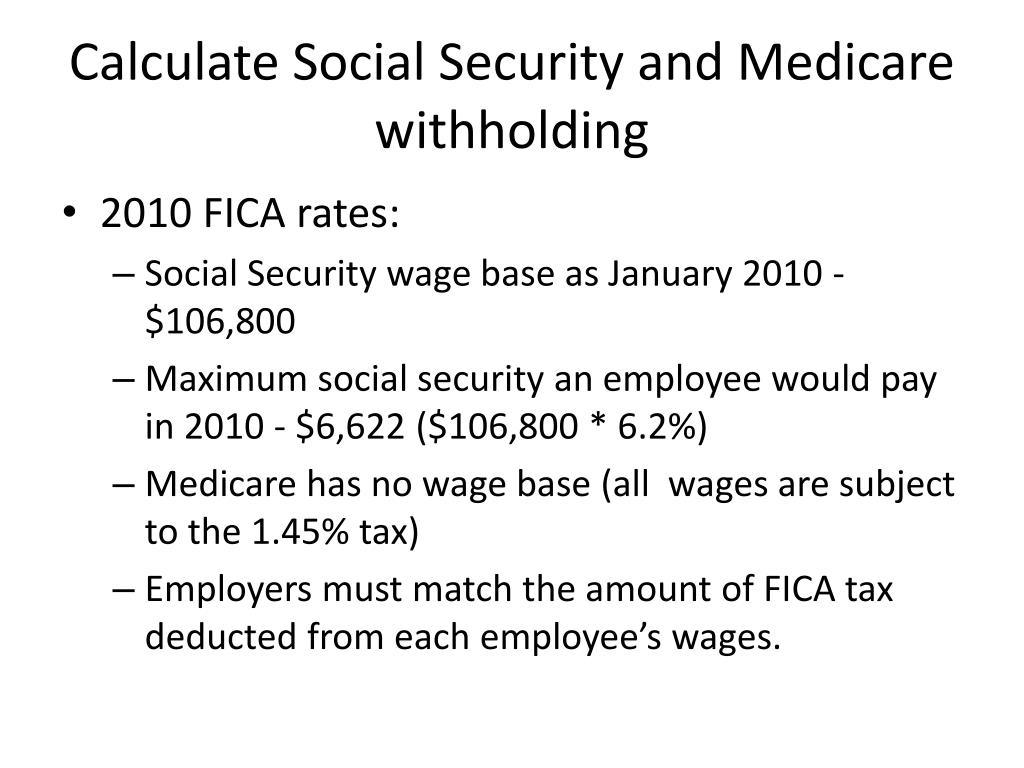

Source: medicare-faqs.com

Source: medicare-faqs.com

What Are The Current Fica And Medicare Rates, That could give you about $56,000 per. Attention to detail is important when discussing fica rates and limits, as they may change each calendar year.

Source: www.pinterest.com

Source: www.pinterest.com

Understanding FICA, Social Security, and Medicare Taxes, For both of them, the current social security and medicare tax rates are 6.2% and 1.45%, respectively. In these cases, employees are entitled to the highest applicable rate.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Maximum Taxable Amount For Social Security Tax (FICA), What are the fica rates and limits for 2024? New york city and the rest of “downstate” (nassau,.

Source: mandieznike.pages.dev

Source: mandieznike.pages.dev

New York State Itemized Deductions 2024 Pia Leeann, Use our fica tax calculator to estimate how much tax you need to pay for social security and medicare tax in line with the federal insurance contributions act. Fica taxes include both social security and medicare taxes.

Source: jazzbumpa.blogspot.com

Source: jazzbumpa.blogspot.com

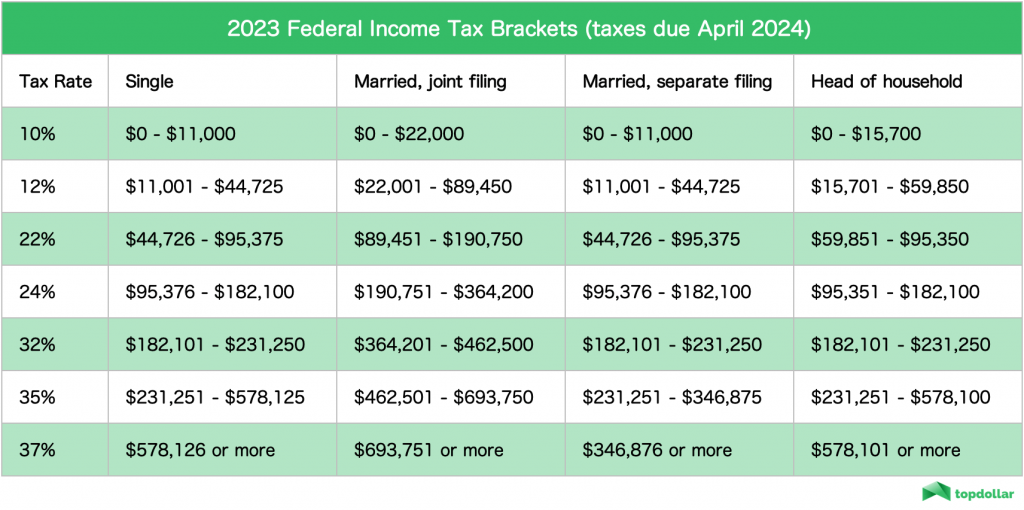

Retirement Blues Effective Tax Rates, Federal insurance contributions act (fica) the wage base will increase from $160,200 to $168,600. In this article, we delve into the specifics of fica taxes, the current rates for 2024, the salary threshold, how to calculate fica tax on your salary, and any potential exemptions.

Source: violaqardelia.pages.dev

Source: violaqardelia.pages.dev

2024 Tax Brackets Vs 2024 Presidential Lanae Miranda, Updates to this chart will be available in. Use our fica tax calculator to estimate how much tax you need to pay for social security and medicare tax in line with the federal insurance contributions act.

What is FICA Tax? Intuit TurboTax Blog, New york also has a state. In these cases, employees are entitled to the highest applicable rate.

Source: www.irstaxapp.com

Source: www.irstaxapp.com

Easiest FICA tax calculator for 2022 & 2023, 29 rows tax rates for each social security trust fund. What is the employer fica rate for 2024?

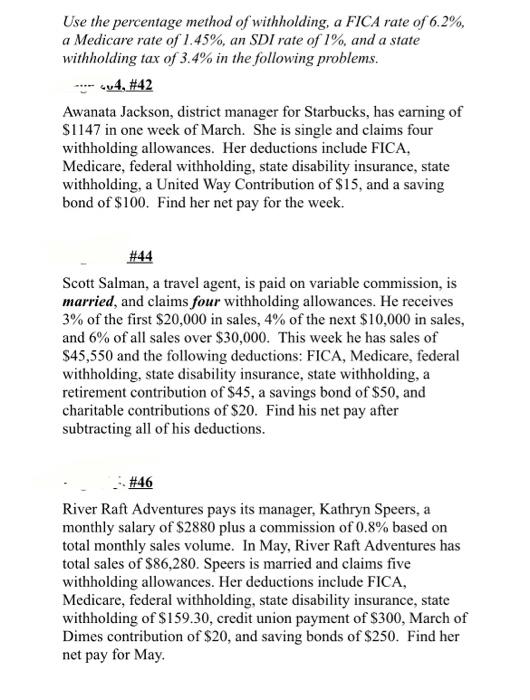

Source: www.chegg.com

Source: www.chegg.com

Solved Use the percentage method of withholding, a FICA rate, 29 rows tax rates for each social security trust fund. Learn about fica for 2024, covering social security and medicare taxes.

Source: 2022vgh.blogspot.com

Source: 2022vgh.blogspot.com

2022 Fica Tax Rates And Limits 2022 VGH, What are the fica rates and limits for 2024? Employers will pay your contribution to fica taxes,.

What Is The Employer Fica Rate For 2024?

Employers will pay your contribution to fica taxes,.

To Calculate Your Fica Tax Burden,.

The following chart shows the state sdi, pfml and ltc rates and taxable wage limits for 2024 based on information currently available.

Posted in 2024